A bit of background...

Ethiopia, the largest and most populated country in the Horn of Africa, is known for its unique geography, ancient history (including the oldest remains of a human ancestor ever found) and cultural diversity – with over 80 languages and 200 dialects spoken in the country.

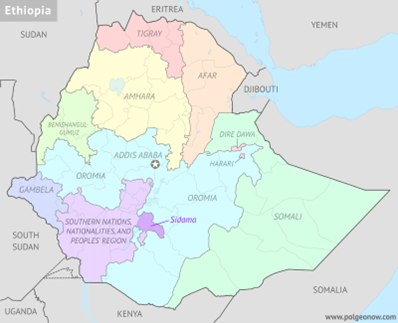

The Somali Region is one of Ethiopia’s largest regions, bordering Djibouti to the north, Somalia to the east and northeast, Kenya to the south, Oromia to the west, and Afar to the northwest. Pastoralism is common in the Somali Region, meaning the economy depends upon animal husbandry and small-scale farming. The region is also host to a number of Internally Displaced Persons (IDPs) as a result of multiple factors including conflict and climate change.

Sharia Compliant Digital Financial Services: ''E-Murabaha'' Loans

The majority religion in the Somali region is Islam – this means Sharia compliant financial services are essential to support financial inclusion. Islamic principles prohibit interest and speculative investments, therefore financial services and products must be designed in a way that accommodates these principles to enable greater economic participation. An example of one such product is Rays MFI’s “E-Murabaha” Loan.

For the purposes of explaining “e-Murabaha” loans, I am going to use a fictional character, Suhai, who I’ve based on individuals I met in focus-group meetings and in stories I heard throughout the monitoring visit. Suhai is 25 years old with two young children. Suhai and her husband are pastoralist farmers who have been impacted by climate-induced stressors – like protracted drought – resulting in the loss of several cattle. Suhai and her husband are therefore looking to diversify their household income, and Suhai would like to become a tailor. One day, she aspires to own her own tailoring shop. Suhai’s long term goal is to increase her income to send her children to secondary school and improve her family’s housing conditions.

For Suhai to realize her tailoring business, she must first buy a sewing machine. But Suhai does not have enough savings to buy this outright. Suhai is a member of a savings group (learn more about SGs here), but the trouble is that other members often need loans too, and the group has not saved enough cash to lend to all its members. Suhai understands there are banks who provide loans, but she has heard that the banks charge interest which conflicts with the Islamic principles Suhai proudly follows, and she doesn’t feel the services and products on offer are appropriate. She has also heard that the application process is often lengthy and she doesn’t have time or extra money to travel back and forth to the capital Jijiga.

How can an NGO like Mercy Corps support rural households like Suhai's in accessing appropriate and relevant digital financial services?

Mercy Corps Ethiopia has extensive experience delivering financial inclusion projects – such as the USAID-funded RIPA Programme which works very closely with the JOA-funded RAISE-DFS project. Throughout the course of our visit, we saw how Mercy Corps seeks to layer and leverage learning across its programmes, to influence and inform the development and delivery of inclusive-financial products and services in Ethiopia.

Mercy Corps Ethiopia has worked closely with partner Financial Institution, Rays MFI to develop its “e-Murabaha” loan - a Sharia-compliant digital financing solution where Rays MFI purchases assets for clients (e.g., goods, machinery, equipment or livestock) and sells them at a profit, allowing installment payments. This loan product facilitates asset acquisition without interest, targeting financial inclusion and convenience for users in line with Islamic finance principles. The digitalised nature of the loan means clients can complete their loan applications (including the upload of Know-Your-Customer documents e.g., ID) online, resulting in a more streamlined application, review and approval process.

Thanks to Mercy Corps’ intervention in partnership with Rays MFI, Suhai can now access an affordable and relevant e-Murabaha loan, allowing her to purchase a sewing machine and start her tailoring business.

Partnerships are paramount to initiate meaningful change

The above example features one of the four Financial Institutions Mercy Corps Ethiopia have partnered with so far under the RAISE-DFS project. Due to time constraints, we could only visit project activities in the Somali Region, however it’s important to mention the other FIs involved in the project, such as Shabelle Bank (also Somali Region), Awash Bank (Afar Region), Siinqee Bank (Oromia Region).

Throughout JOA’s visit, we were fortunate to observe Mercy Corps’ convening power and the team’s dedication to increasing dialogue, lessons sharing and advocacy around the financial inclusion of rural households and those hardest to reach in Ethiopia. We attended a day-long roundtable event in Addis Ababa which brought together representatives from financial institutions, as well as other JOA partners (such as SCIAF), to discuss the overall financial inclusion landscape in Ethiopia and to compare and contrast particular challenges and best practices observed in the first two years of project implementation.

The discussions outlined how financial inclusion, access to digital financial services (including infrastructure e.g., network coverage) and overall uptake of such services vary hugely across the three different regions. For example, the Somali Region borders Kenya – a country wherein mobile network coverage is expansive, and adoption and uptake of digital financial services (e.g., mobile money) is widespread. It is therefore unsurprising that Mercy Corps has observed a quicker uptake and adoption of DFS services and products developed within the project. By contrast, in the Afar and Oromia regions, we heard more about why uptake has been a little slower, with influencing factors such as the lack of supporting infrastructure and more hesitation and concerns around DFS among participating communities.

Common challenges affecting all three regions include the regulatory environment – for example, the National Bank of Ethiopia recently introduced new regulations that have limited the growth of commercial banks like Awash, Siinqee and Shabelle Banks meaning they are restricted in the number of clients they can reach. Also, the digital gender gap remains prevalent which limits women’s access to technology, hindering education, access to economic opportunities, and social inclusion. Mercy Corps Ethiopia is working closely with its partner FIs to address this and deliver digital financial services that are accessible, relevant and gender-inclusive.

As the project enters its third and final year, Mercy Corps Ethiopia plans to build on its success and scale-up the intervention by onboarding a fifth FI partner - the Cooperative Bank of Oromia. We look forward to seeing the results of the independent endline evaluation, and project Final Report in 2025.