These are challenging times. The global economic outlook remains uncertain, and even here in Jersey, we’re feeling the pressure. Rising costs, financial insecurity, and climate concerns are affecting households and communities across the island. In difficult times like these, we do what people everywhere do: we cut back, save where we can, and try to protect those we love. We look for stability something to fall back on when things go wrong.

But what if you didn’t have those options? What if you had no savings, no insurance, no line of credit, and no social safety net?

Established in 1995, the Consultative Group to Assist the Poor (CGAP) is a coalition of more than 35 of the world’s leading development agencies that work to advance the lives of people living in poverty, especially women, through financial inclusion.

Last week, I had the opportunity to attend the CGAP Annual conference in Amsterdam, a gathering of experts and organisations from around the world who share a commitment to fighting poverty through better access to financial services. The theme this year Rethinking Resilience couldn’t be timelier.

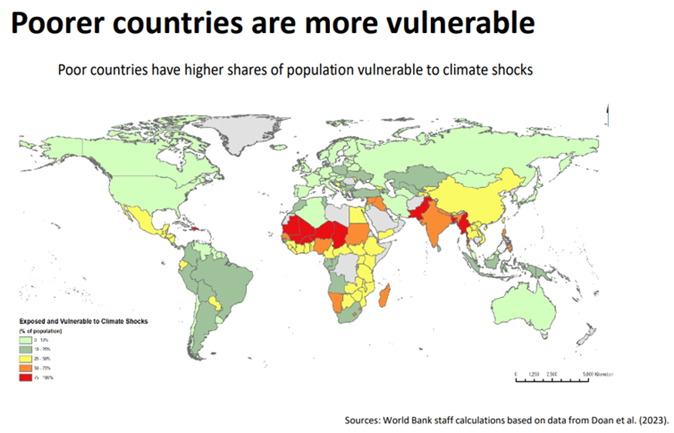

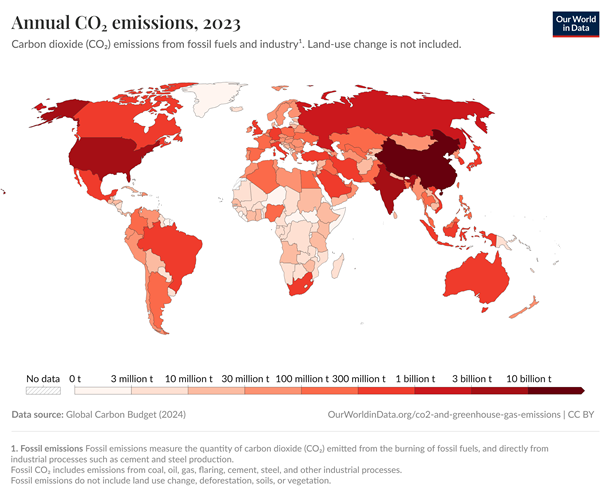

As storms, floods, droughts and other shocks become more frequent and more intense, families in low-income countries are hit the hardest. A powerful insight shared at the event stayed with me: the poorest half of the world’s population produce just around 12% of global greenhouse gas emissions, yet they are expected to shoulder a disproportionate share of the financial cost of climate change, amounting to billions of dollars by 2030. By 2030, climate change and disasters could push an additional 132 million people into poverty (Jafino et al. 2020).

That’s not just unfair it’s a wake-up call. But there is hope and opportunity and it comes under the title of ‘inclusive finance’.

What do we mean by ‘inclusive finance’ and how does it build resilience?

Inclusive finance is about making sure everyone especially people who are often excluded from banks or formal systems can access the financial tools they need to manage their money, protect themselves, and invest in their future.

Resilience means being able to prepare and recover quickly. When there is a flood, it means getting early warning, investing in sandbags and protection for your home, planting flood-resistant crops. It also means having savings to be able to afford the financial losses. All of these things require financial services.

Those financial services could be something as basic as a savings account, a small loan to grow a business, or insurance to protect against crop losses. It might also include mobile money services, low-cost money transfers and payments, or government cash transfers delivered securely and reliably.

At JOA, we see these types of tools and services as essential to tackling poverty and climate change.

What I learned in Amsterdam

The two-day conference brought together government donors, impact investors, development banks, financial institutions, foundations and social enterprises. Here are some of the big takeaways I left with:

- Financial services build resilience in three powerful ways:

The CGAP report Resilience for All: Why Inclusive Finance Can’t Wait outlines how financial tools help people cope, adapt, and ultimately thrive in the face of shocks:

- Absorbing shocks: Emergency savings, microinsurance, or flexible credit can help families recover from a failed harvest, health crisis or unexpected expense without selling their assets or pulling children from school.

- Adapting for the future: Access to finance can enable investments in better tools, education or climate-resilient farming, helping people reduce risk and seize new opportunities.

- Transforming communities: When inclusive financial systems are strong connected to data, markets, and social protection they can drive broader changes and lift entire communities.

- The poorest are the most exposed and the least equipped

Climate change is no longer a distant risk. It’s already threatening lives and livelihoods. But the people on the frontlines often lack the financial safety nets to protect themselves or bounce back.

A big part of the solution lies in expanding financial services in the right way through systems that are accessible, affordable, and designed with people’s real needs in mind.

- ‘Tech + touch’ is better than tech alone

We had an interesting debate about tech vs touch solutions. Mobile banking has huge potential but brings with it massive risks. Tech solutions are often not adopted because of lack of digital know-how, or even because people don’t have access to mobile phones themselves, or they lack phone signal in rural areas. More importantly, people still trade using physical cash, and don’t trust the tech. Digital tools like mobile banking and online lending platforms have huge potential, but what works best is often a combination: technology that saves time and cost, supported by trusted local agents or community groups.

- Africa is a missed opportunity and a place of immense potential

Much of the world’s unmet need for inclusive finance is in Africa. Yet investment there remains limited. With smart partnerships, better infrastructure, and good regulation, this could be turned around. In fact we heard from FMO (the Dutch Development Finance Institution that invests in climate resilience).

FMO in partnership with BII (their counterparts in the UK), have created a Climate Investment Playbook -(Climate Investment Playbook - FMO_) - a guide for private equity and investors that goes through strategy, due diligence, measurement, and exit from a climate lens. In 2023, Venture Capital / Private Equity channelled an impressive $56 billion into climate solutions globally, showing that investors are now willing to step up. FMO reminds us that climate adaptation isn’t far-off it’s here and now. With an estimated $2 trillion per year of investment potential by 2026, focused action in this space is smart. Tools like this make it easier for investors, including JOA partners, to join the wave.

- Trust, protection and good regulation are vital

Inclusive finance isn’t just about reaching more people it’s about reaching them safely. That means strong consumer protection, cybersecurity, and transparent services that people can trust and understand.

What does this mean for JOA?

As a relatively small international aid donor, we understanding how vitally important it is to collaborate. Siloed working leads to duplication and wasted resources. This is something that we cannot afford to do. Jersey Overseas Aid is proud to be a member of the CGAP Council of Governors we can learn from what’s working and use our limited resources to deliver the maximum impact. We invest in financial inclusion projects in six target countries, helping ensure that women, smallholder farmers, and marginalised communities have access to the tools they need to build brighter, safer futures.

At JOA, we’re committed to designing and scaling programmes that are:

- Evidence-based: Informed not only by local needs, but by global data and forward-looking models.

- Collaborative: Partnering with governments, financial institutions, and tech innovators to reach the last mile.

- Safeguarded: Built on strong regulatory frameworks and trust-building measures.

There is momentum amongst the development community, but now more than ever we must be determined to work together with our private sector counterparts. We’re not starting from scratch. But we do need to go further and faster and we need to do it together. Especially as climate impacts accelerate.

The CGAP report is an excellent resource for understanding this challenge and opportunity. You can read it here:

🔗 Resilience for All: Why Inclusive Finance Can’t Wait